- How to write a reference letter how to#

- How to write a reference letter verification#

- How to write a reference letter professional#

- How to write a reference letter free#

When your client requests a reference letter, ask them to detail their objectives.

How to write a reference letter how to#

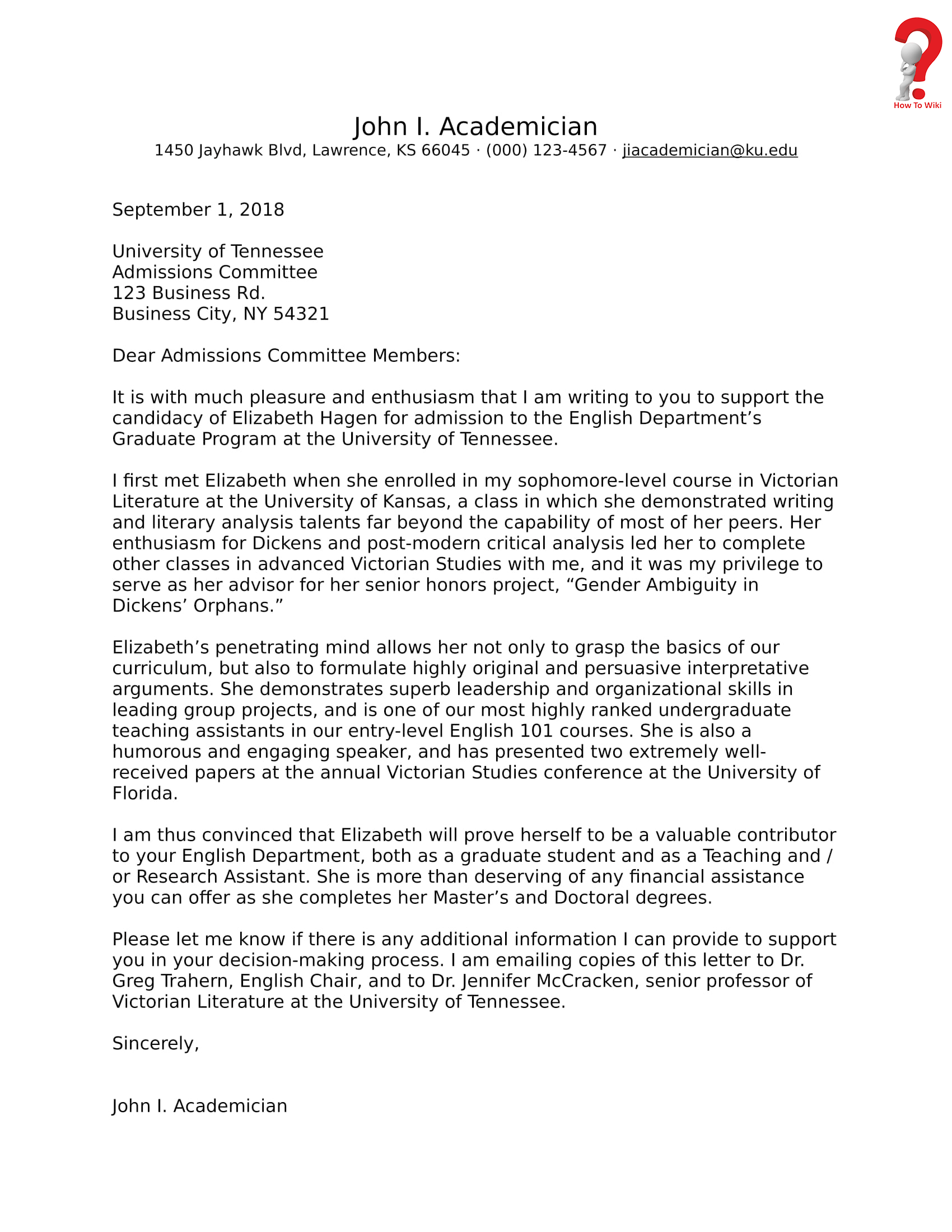

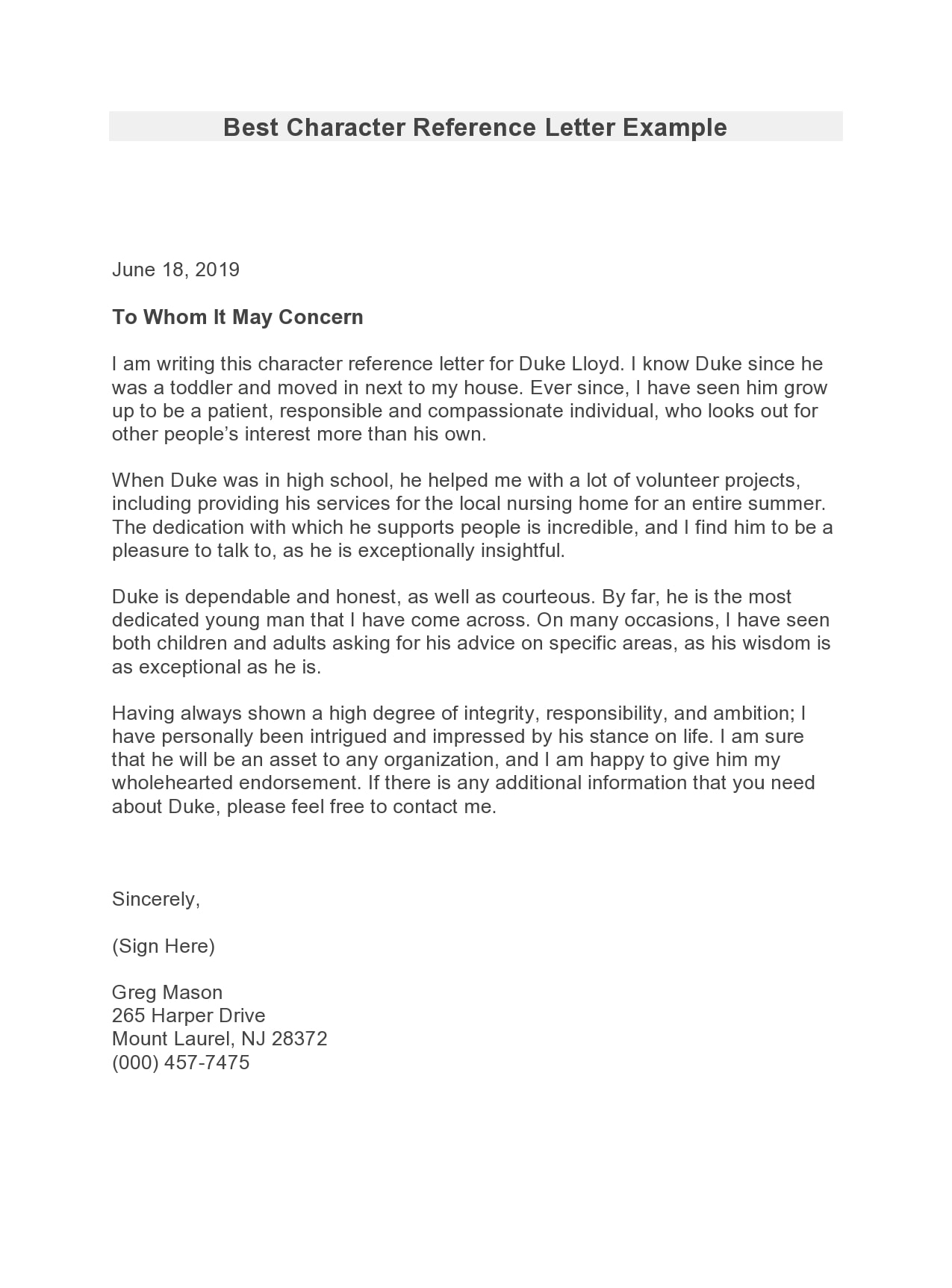

Here are the steps for how to write a financial reference for a client: 1. Read more: Notary Public Certifications: What You Need To Know How to write a financial reference letter Make sure that all the information in the letter is accurate to the best of your knowledge, especially if a notary public certifies your document, as this could have legal implications. The key components to include in a financial letter of reference are:Ī description of your relationship with the clientĪ confirmation of the client's good financial statusĭetails that support your client's financial status The details contained in the letter may depend on its intent, but the formatting is fairly standard. While the letter itself has one primary purpose, it's possible for it to be used as evidence in a different formal setting, such as a civil court proceeding. Related: Learn About Being a CPA (Certified Public Accountant) What's included in a financial reference letter?Ī financial reference letter is an official document, and there are specific requirements to legitimize its contents. Property owner or intermediary: A client attempting to start a rental lease may connect you to the property owner or an intermediary, such as a landlord or broker, so you can attest to their financial stability.īusiness associate: If you're working as a financial consultant or commercial vendor for your client, they may ask you to send a reference letter to an associate who's considering a business partnership with them.

How to write a reference letter free#

Members of a co-op board: Co-op housing situations are apartment buildings where a group of existing residents evaluates every new tenant, and they usually request financial documentation as part of the application process.īanker at a different financial institution: Businesses often look for funding from multiple sources, so your client may be applying for loans at other banks or financial institutions that want to confirm their viability.Ĭollege loan reviewer: College financial aid packages in some income brackets may contain student loans, meaning your client may need a reference letter as part of their Free Application for Federal Student Aid ( FAFSA) package. Here are some examples of the people for whom you may write the letter:

How to write a reference letter verification#

The person, company or board to whom they are applying has requested verification of their financial situation. Recommendation Letters Who uses financial reference letters?Ĭlients may request a financial reference letter for a variety of situations that focus on a review of their finances. The writing uses tangible statements rather than referring to abstract qualities.

It may include examples of their ability to maintain financial relationships. It includes affirmations of the client's financial responsibility and steadiness.

Unlike a letter of recommendation, a reference letter is an objective statement that supports an individual's or group's claims about their financial situation. Situations where someone may need a financial letter of reference include: Financial professionals and accountants can write them for clients who need proof of their finances beyond banking records. What is a financial reference letter?Ī financial reference letter is a document that verifies an individual's or company's financial history and reputation. In this article, we explore the financial reference letter, including its components and who uses it, give steps for how to write one and provide a template and example so you can write a financial reference letter on behalf of your clients. Your client typically makes this request because they trust your judgment, so it's important to understand how to write an effective letter. Occasionally, a client may ask you to provide a financial reference letter in order to confirm their financial status.

How to write a reference letter professional#

If you work in the finance industry, your professional reputation and expertise give you credibility to verify certain information about your clients.

0 kommentar(er)

0 kommentar(er)